Hispanics in Hiding – Understanding Hispanics’ Reactions to the Trump Administration

In light of the new immigration policies by the Trump administration and dramatic increases in ICE raids on undocumented Hispanics, clients came to us with concerns regarding declining sales driven by Hispanic consumers. This merited a study, looking at Hispanics’ perceptions of and reactions to the early days of the Trump administration.

The study helps us to answer critical questions for today’s biggest brands.

- Are Hispanics sending more remittances this year?

- Is fear affecting the amount of time they spend outside their homes?

- Are they shopping online more often and/or in bulk to avoid being in public?

- Have undocumented Hispanics changed their behaviors? How so?

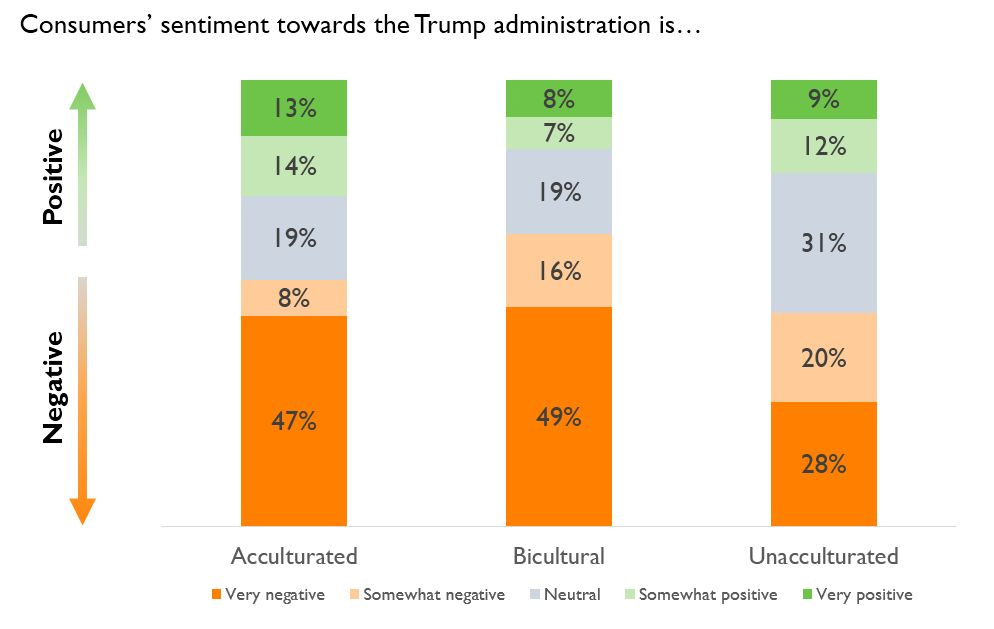

Most Hispanics have a negative perception of the Trump administration

Sixty-five percent of bicultural and 55% of acculturated Hispanics report that they feel negatively towards the Trump administration, compared to 48% of unacculturated Hispanics. Despite being most affected by Trump’s policies, unacculturated Hispanics are almost half as likely to feel “very negatively” towards the administration.

Impact on Shopping and Dining Out

Online and club stores are driving increased shopping frequency among Hispanics. Roughly a quarter of Hispanics report shopping at online (28%) and club stores (25%) more than they did in 2016. Unacculturated Hispanics are significantly more likely than their more acculturated counterparts to report increased shopping frequency at club stores (A: 17%, B:19%, U: 28%).

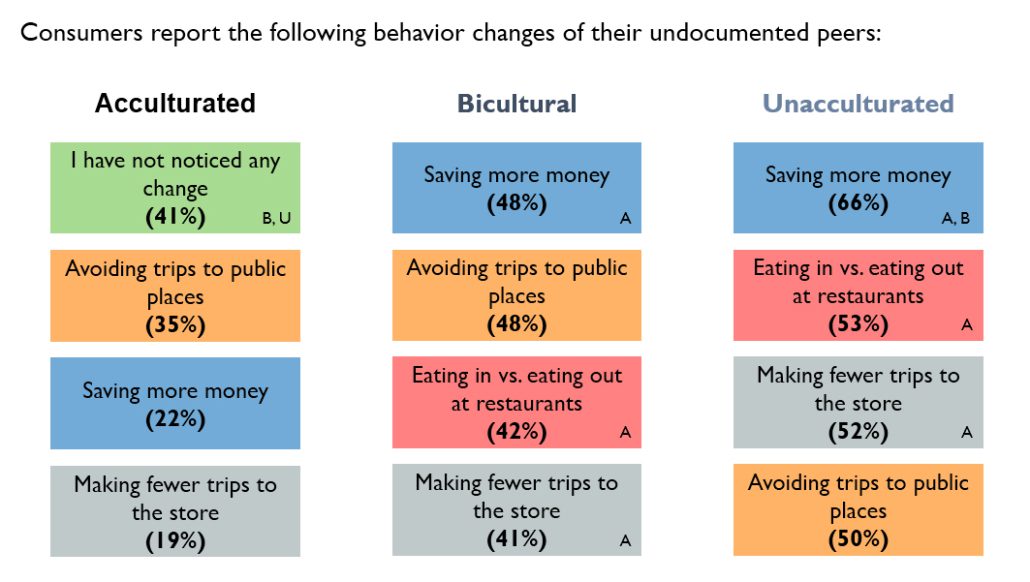

More than ¼ of Hispanics eat out at restaurants less than in 2016. They also report that undocumented individuals are going to restaurants less. Reasons for this decrease could be a combination of (1) fear of stepping out of their homes, and (2) needing to save money in case the political situation becomes worse.

Spending Less

Hispanics report that their undocumented peers are saving more money as a result of the Trump administration. Spending less can translate into fewer product purchases and recreational outings, such as going to the movies, for example. Other behavioral changes mentioned include avoiding public spaces, eating in instead of going out, and making fewer trips to the store.

Most Don’t Plan to Leave

More than half, across acculturation levels, say that the mixed-status families they know are planning on staying in the U.S. Unsurprisingly, acculturated Hispanics are the most likely to say that the mixed-status families they know are planning to stay, compared to their less acculturated counterparts (A:79%, B:64%, U: 59%). Interestingly, roughly a third of bicultural and unacculturated Hispanics report that the mixed-status families they know are still deciding whether to stay in the U.S. or move abroad.

Access the Findings

These findings are just the tip of the iceberg. While Hispanics are not leaving the country, their behaviors are changing. Brands need to monitor these behaviors and adapt to these changes, which can be challenging!

Please complete the form below to receive additional information from Collage Group.

Stay Informed

Email *:

MARKET RESEARCH

SOLUTIONS

fluen.ci App for Cultural Insights

Consumer Research Data & Tools

RESOURCES

Webinar & Events

ABOUT

Who We Are

Collage Group is a certified Minority Business Enterprise (MBE) by the National Minority Supplier Development Council (NMSDC).

©2023 Collage Group

4550 Montgomery Avenue

Bethesda, Maryland, 20814

(240) 482-8260

Stay Informed

Email *:

Collage Group is a certified Minority Business Enterprise (MBE) by the National Minority Supplier Development Council (NMSDC).

©2023 Collage Group