Buying Auto Insurance? What Matters Most to Multicultural Consumers

Car insurance is an important asset to many multicultural consumers across the U.S. As such, it’s critical for brands to understand how they choose insurance companies and their path-to-purchase.

These highlights are part of our recent work exploring multicultural consumers’ attitudes and preferences towards insurance more generally, including life insurance, home insurance, and auto insurance.

Pre-Purchase Considerations

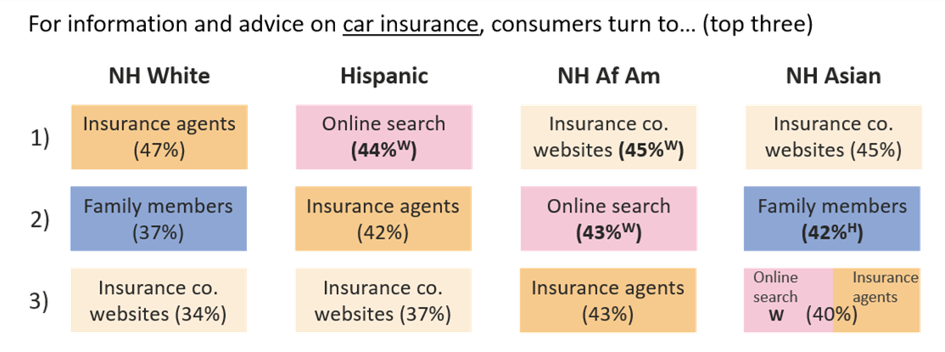

Hispanics and African-Americans look to experts online and offline for advice, while Asians also turn to family. Make sure your agents are knowledgeable and feel accessible to prospective customers, online and in person.

Almost 75% of Hispanics want to get at least some car insurance information in Spanish. Most Asians, on the other hand, look for information in English. If you are targeting bicultural and unacculturated Hispanics, make sure to have at least some Spanish info online.

Purchase Drivers

Transparency, customer service, and offering a good value are essential across the board. Consider offering free price comparisons to show your company is transparent.

Online presence is a big factor for Hispanic consumers. In fact, they’re more likely to say a strong website, the ability to purchase online, and a good mobile app are essential to their purchase decision. Make sure your site is easy to navigate and provides clear information about your product offerings.

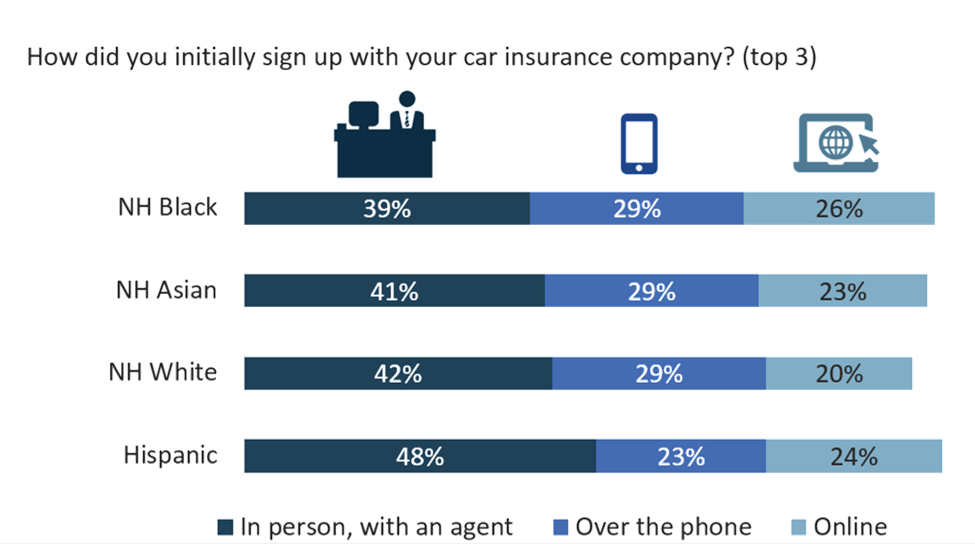

Consumers buy car insurance online more often than other insurance insurance types. Although many buy insurance in-person, others close the deal online or via phone. Consumers purchase auto insurance at multiple points. So it’s smart to ensure quality of service in-person, on-the-phone, and online. Since car insurance is a complicated service, make sure the online purchase process is simple.

Post-Purchase Dynamics

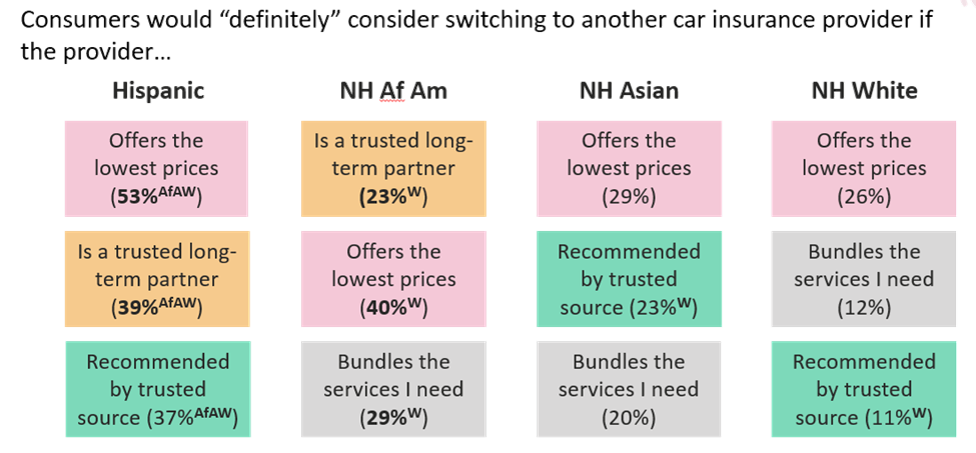

Hispanics and African-Americans would consider switching auto insurance providers for a brand they trust. Therefor, brands should provide testimonials around their customer relationships. Validate trust by making it easy for customers to make an appointment to speak to agent in-person, or by phone.

If completing an auto insurance matter online, laptops are the device of choice, but consumers are open to receiving some features on their phone. These include receiving alerts, filing claims, or getting policy quotes. Develop simple mobile apps that allow users to access their policies and insurance cards, and set up an an easy way to make payments.

What does this mean for marketers?

In the initial stages of choosing a car insurance company, multicultural consumers rely on online research. Brands can help persuade multicultural consumers to buy their policies by investing in easy-to-use and informative brand websites. After these consumers have purchased the policies, they emphasize the importance of in-person interactions and a strong relationship with their car insurance company. It’s savvy for brands to invest in training agents to keep consumers engaged with your brand.

Download this excerpt of our latest Category Essentials release specific to financial services and automotive:

Stay Informed

Email *:

MARKET RESEARCH

SOLUTIONS

fluen.ci App for Cultural Insights

Consumer Research Data & Tools

RESOURCES

Webinar & Events

ABOUT

Who We Are

Collage Group is a certified Minority Business Enterprise (MBE) by the National Minority Supplier Development Council (NMSDC).

©2023 Collage Group

4550 Montgomery Avenue

Bethesda, Maryland, 20814

(240) 482-8260

Stay Informed

Email *:

Collage Group is a certified Minority Business Enterprise (MBE) by the National Minority Supplier Development Council (NMSDC).

©2023 Collage Group