Changes in Multicultural Consumer Spending and Financial Behavior Across Categories

A baseline pattern of consumer behavior was established in series of surveys at the end of February, March and April, before moving to a bimonthly deployment. In June, behavior was largely unchanged with slightly looser spending behavior for all but Hispanic consumers.

Fill out the form for an excerpt from our Economic Tracker: June 2023 presentation.

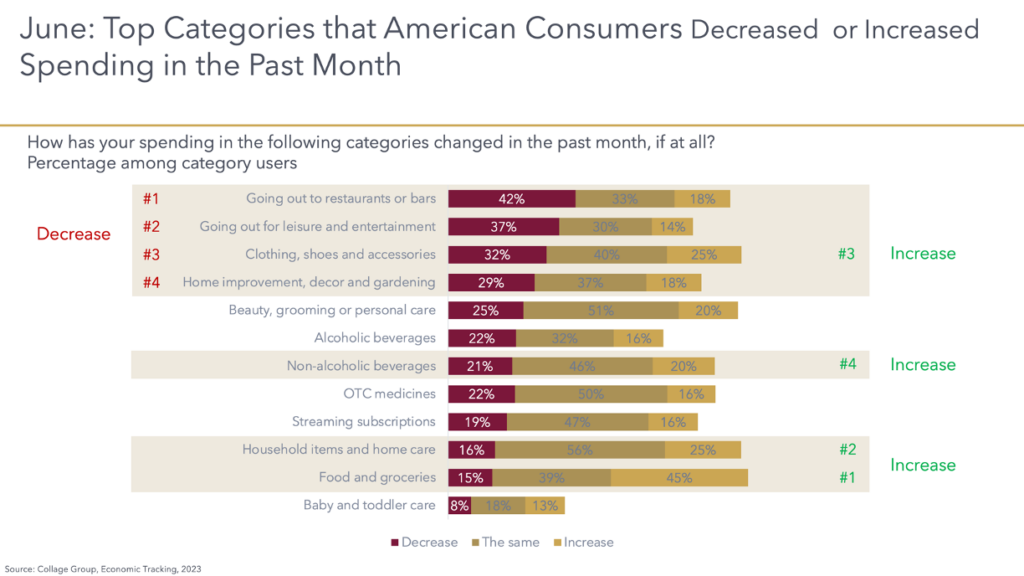

Across all consumers, the top four categories of decreased spending include: Going Out to Restaurants & Bars, Going Out for Leisure & Entertainment, Clothing, Shoes & Beauty, and Home Improvement & Gardening. The top four categories of increased spending include: Food and Groceries, Household Items and Home Care, Non-Alcoholic Beverages, and Clothing, Shoes & Accessories. These remain stable over time.

Of twelve spending categories tracked, 35% of consumers reported decreased spending in at least four categories in April, down slightly since April. Meanwhile, 26% of consumers reported increased spending in at least four categories in June, a slight decline since the prior assessment in April.

There is no variation in the rank order of the categories of decreased spending by race or ethnicity, with Asian and White consumers reporting overall slightly higher percentages than Black or Hispanic consumers. Notably, Hispanic consumers reported small increases in decreased spending in Bars and Restaurants, Movies, Sports or Games, and Clothing. White consumers report a slight decrease in decreased spending on Movies, Sports or Games, Clothing or Home Improvement.

Contact us to learn more about how you can gain access to these diverse consumer insights and much more in our Cultural Intelligence Engine. Our solutions and expertise will help you make cultural fluency part of your brand’s DNA, so you can become culturally resonant and achieve your growth goals.