Health and Wellness Across Gender

Men and Women have unique perspectives, needs, and experiences related to health insurance and health care. Keep reading for key insights, and a downloadable deck to help your brand or organization better connect with these segments.

Americans are increasingly embracing a consumer mindset when it comes to healthcare. Men and Women alike are shopping around, comparing prices, and seeking more information than they have in the past. They are doing this because heath care has changed – it has expanded choice and shifted costs.

To win in this constantly evolving space, brands and organizations need to understand men and women’s unique health-related perspectives and how they impact their engagement with health insurers and providers.

Collage Group’s 2021/2022 Health & Wellness Study leverages data captured from more than 3,500 Americans to help brands understand how health-related attitudes and behaviors differ by gender. Our research reveals how an emerging consumer mindset impacts Americans engagement with both the health insurance and health care provider space. We explore barriers to insurance coverage, drivers and barriers to trust and satisfaction, provider preferences, receptivity to provider advice, and more.

Download the attached presentation and take a look at a few key insights and implications below:

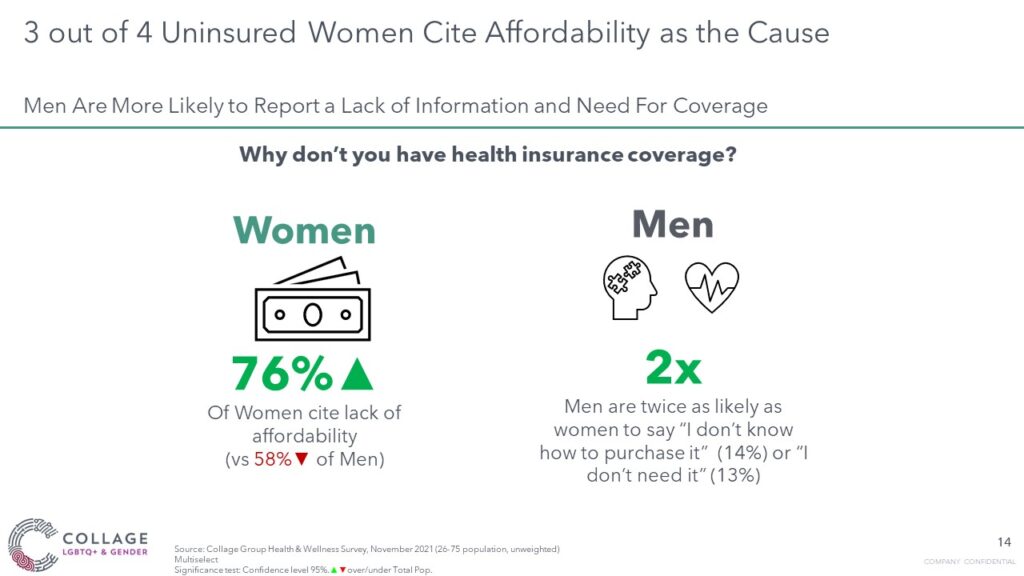

#1: Affordability is the Top Barrier for the Uninsured

The high cost of healthcare for Americans is not news, we know that men and women both face increasing costs and are seeking ways to offset them. But for women, costs are even higher earlier in life, thanks to increased incidence of many chronic conditions, as well as the healthcare costs associated with their reproductive years. This leads many to cut costs by forgoing care or insurance altogether – lack of affordability is the top reason why uninsured women don’t have coverage.

Affordability is also the top reason why men don’t have insurance, albeit at a much lower rate. But what’s interesting – and actionable for healthcare brands – is that men are twice as likely as women to say that they don’t have health insurance because they don’t know how to purchase it. They’re also twice as likely to say they don’t have health insurance because they don’t need it.

Best Practice: The Nevada Health Link took a creative approach to attracting the cost conscious uninsured. Their creative campaign titled, “You Can’t Afford to Not Be Insured”, highlighted the savings insurance provides when faced with a variety of common ailments compared to paying out of pocket – presenting insurance as a relative value.

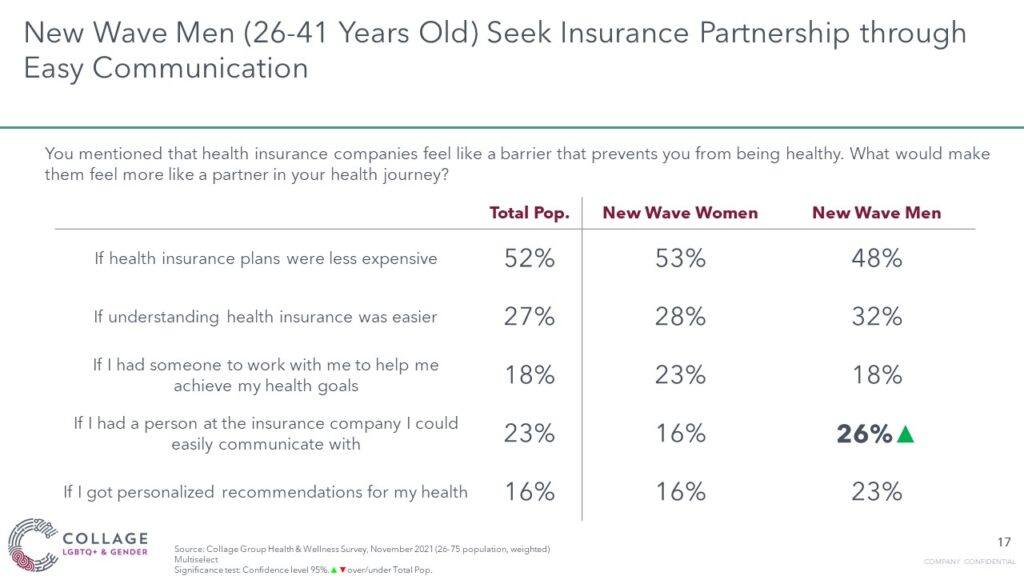

#2: Men Seek Insurance Partnership Through Communication

Communication with their health insurance provider is particularly important for New Wave Men – those who are 26-41 in this study. When asked what insurance companies might do to be seen as a partner rather than a barrier in improving health, New Wave men were significantly more likely to say “If I had a person at the insurance company I could easily communicate with.”

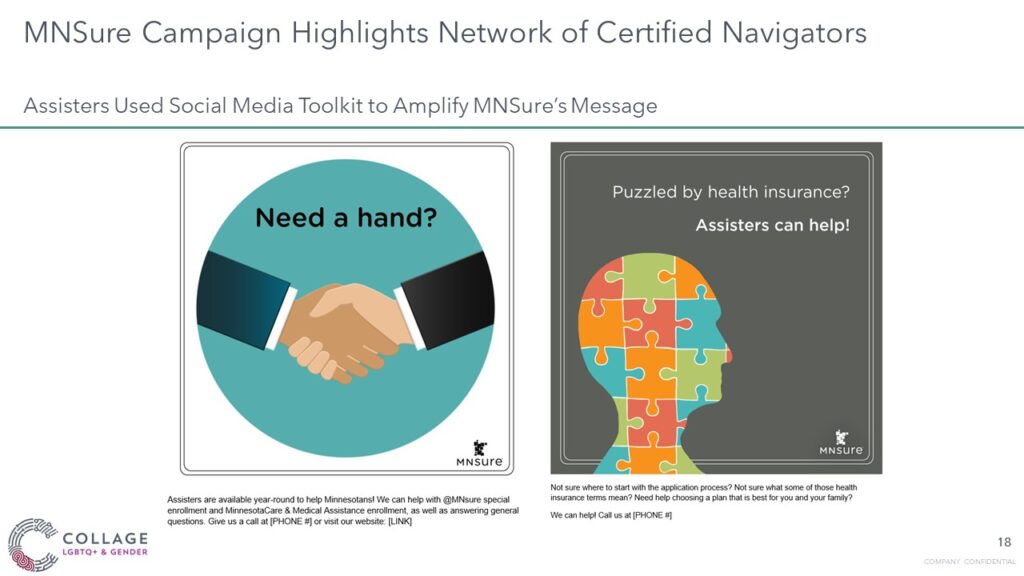

Best Practice: The state of Minnesota health insurance exchange, or “MNSure”, recently ran a campaign highlighting the communication support provided to those seeking to enroll. MNSure utilizes a network of “assisters” who provide 1:1 support on social channels, year round. The ads seen below were designed to be shared by the assister network across social channels, so individuals could reach out to the assisters directly to receive support, or through the provided contact information.

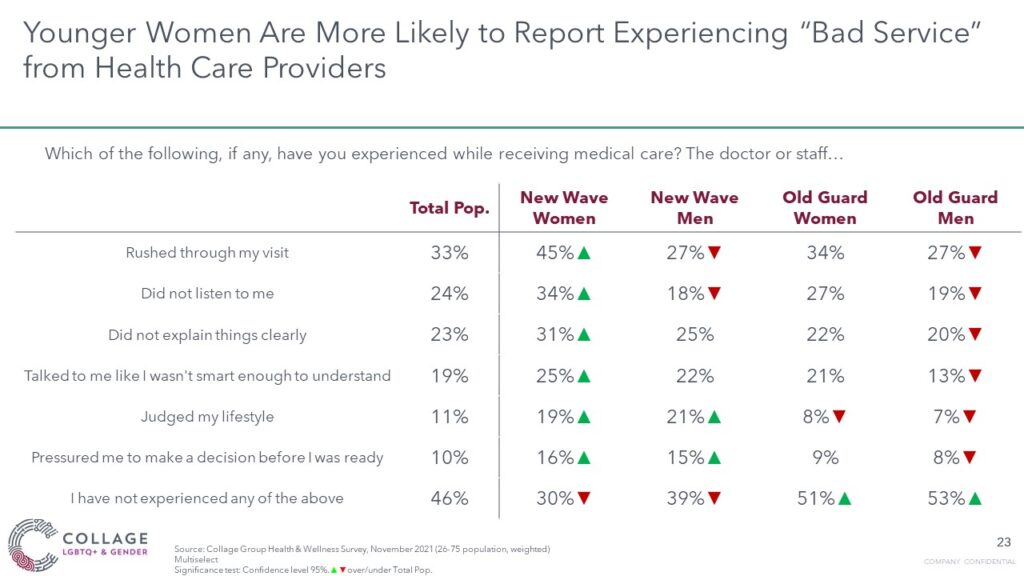

#3: New Wave Women Have Endured Negative Healthcare Services, Leading to Lower Healthcare Satisfaction

Of all segments we looked at in this study, younger women (26-41yrs old) have the lowest level of satisfaction of their health care providers. And the unfortunate truth behind this number seems to be that they have simply had more negative experiences with health care providers in the past. In fact, younger women are significantly more likely to have experienced literally every negative experience we asked about – from doctors rushing through visits and not listening to them, to lifestyle judgment and pressured decision making.

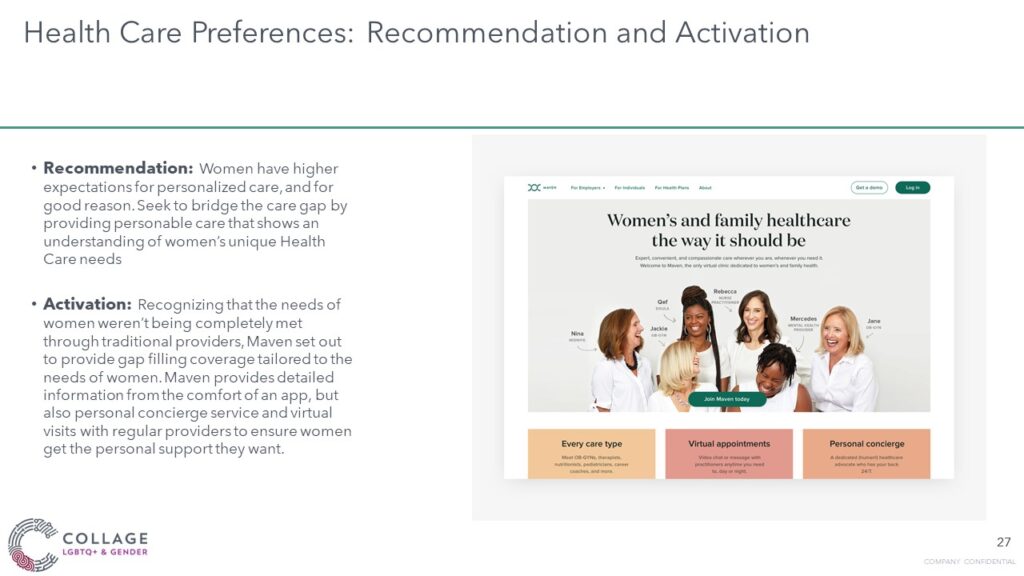

The silver lining of the negative experiences women have had in the past is that they now know what they want from health care providers. Women want personalized care, from doctors who understand their unique healthcare needs, and they want it delivered in a way that is efficient and effective.

Best Practice: Recognizing that the needs of women weren’t being completely met through traditional providers, Maven Health set up gap-filling coverage tailored to the needs of women. Maven provides detailed information from the comfort of an app, but also personal concierge service and virtual visits with regular providers to ensure women get the personal support they want.

Contact us to learn more about how you can gain access to these diverse consumer insights and much more in our cultural intelligence engine.