Understanding Hispanic American Acculturation

The Hispanic population in the U.S. is large and growing. Understanding the diversity within the segment as well as their priorities is vital for brands and marketers to grow right alongside this critical American consumer segment.

As of the 2020 Census, there were 62 million Americans who identified as Hispanic. This segment accounts for over 50% of total population growth in the U.S. and it’s native-born Hispanic Americans– not new immigrants to the country– who are driving virtually all of that growth.

Fill out the form for an excerpt from our Understanding Hispanic Americans presentation.

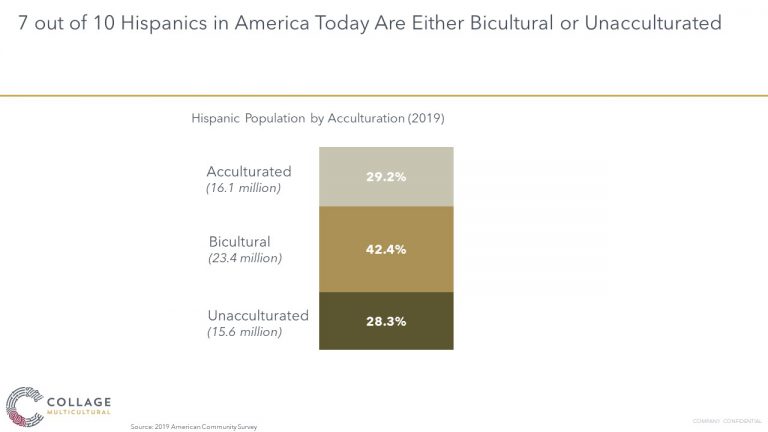

Importantly, the segment is comprised of three sub-groups across the spectrum of acculturation: acculturated, bicultural, and unacculturated.

Those sub-groups are based on Collage’s own acculturation model designed to better understand the Hispanic segment through cultural preferences. Our model mostly focuses on language usage (Spanish, English, or both) but also includes an identity component. And, when we look at the population of Hispanic Americans by acculturation, we see that the largest and fastest growing group is Bicultural Hispanic Americans. In addition to proportional size, the Bicultural Hispanic segment is also the youngest, ensuring future growth (and importance to your messaging) too.

But, to better understand Hispanic American consumers, you need to go beyond demographic size and acculturation. Our recent research into Hispanic identity and behavior offers a set of key findings for brands and marketers when it comes to understanding and engaging with Hispanic Americans.

- Hispanic Americans prefer the terms Hispanic and Latino/Latina as their identifiers. There are also some terms the segment clearly does not prefer.

- Ethnicity and country of origin are key parts of Hispanic Americans’ identity and supersede other characteristics, like gender or life stage.

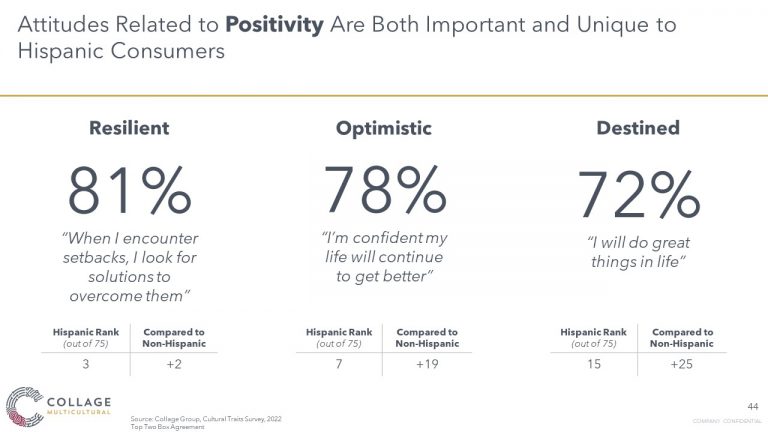

- Hispanic Americans are a uniquely positive segment, displaying optimism even when times are tough.

- Hispanic Americans are social media super users. The segment’s overall youth and forward-thinking nature have a big part to play in this.

- Hispanic Americans want to preserve their culture while living in America, particularly through cooking and enjoying traditional meals.

Keep reading to learn more about each of the key findings above and download the attached document for a selection of our summary findings.

Key Hispanic Consumer Insight #1

Hispanic Americans prefer the terms Hispanic and Latino/Latina as their identifiers. There are also some terms the segment clearly does not prefer.

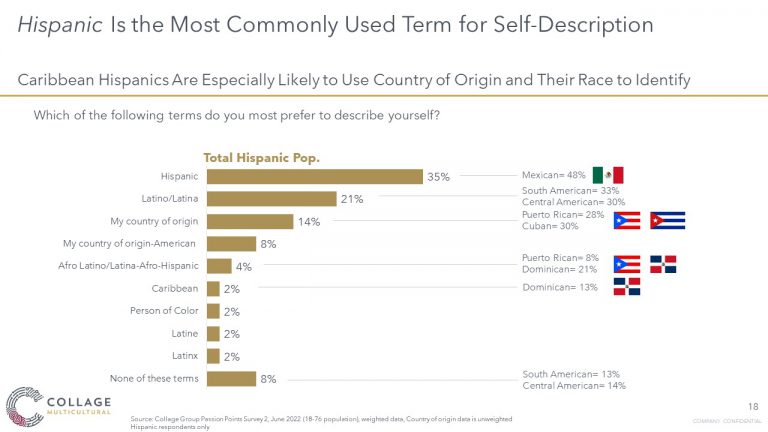

When it comes to identifying terms, Hispanic Americans clearly have a preference. “Hispanic” and “Latino/Latina” top the list overall for the segment, with “Hispanic American” winning overall especially with Mexican Americans. South Americans and Central Americans are more inclined to use the label Latino/Latina.

For Puerto Ricans and Cuban Americans, their preference for using country of origin as their prime identifier really shows up, as well.

Despite the recent popularity of the term “Latinx” to denote inclusivity, you can see that it clearly does not resonate with many Hispanic Americans; It’s the lowest on the list, alongside “Latine” and “Person of Color.”

Action Step

Use either the terms Hispanic or Latino/Latina when you want to refer to Hispanic Americans in general.

If your target is Latin Americans living in the US, defer to Latino/Latina. And keep in mind that despite broad appeal, these terms are not technically synonymous. Hispanic refers to people from Spanish-speaking countries, while Latino/Latina refers to the geography of Latin America.

Key Hispanic Consumer Insight #2

Ethnicity and country of origin are key parts of Hispanic Americans’ identity and supersede other characteristics, like gender or life stage.

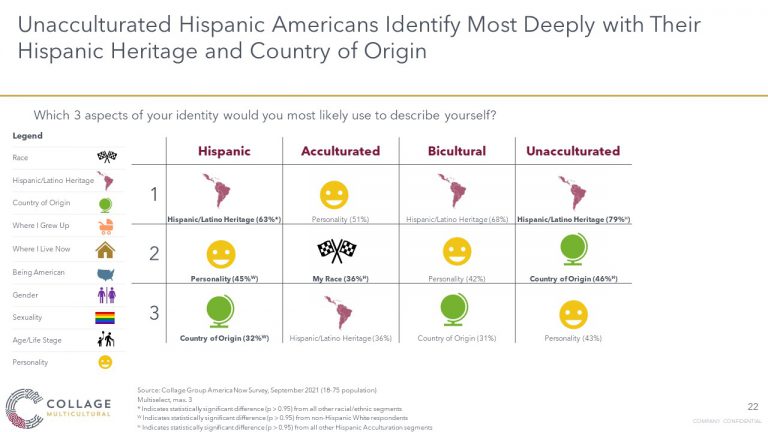

In a recent survey, we asked Hispanic Americans which three aspects of their identity they would use to describe themselves. Hispanic/Latino heritage (i.e. ethnicity) tops the list at 63%. And when we look at this by Acculturation, we see that the percentage for Hispanic/Latino heritage jumps to 79% for the Unacculturated segment and 68% for the Bicultural Hispanic Americans.

What’s more, country of origin also moves up higher for Unacculturated Hispanic Americans with 46% of them noting this as a key part of who they are. This is likely due to the sub-segment’s stronger affiliation with the U.S. rather than another country. Acculturated Hispanic Americans lean into their personality and race more than other Hispanic Americans. But despite those differences, Hispanic/Latino heritage is still in the top three for the Acculturated segment too.

Action Step

Craft marketing messaging that celebrates the diversity of the segment.

Even when messaging is narrowly targeted to a specific Hispanic sub-segment, the crossover appeal of taking the time to understand the nuances of identity will be seen and valued across the entire segment.

Contact us to learn more about how you can gain access to these diverse consumer insights and much more in our Cultural Intelligence Engine.